What is FinOps?

FinOps is a cultural and operational practice that aligns engineering, finance, and business teams to manage cloud expenses effectively. It fosters collaboration and transparency, combining financial insights with engineering expertise to help organizations track cloud costs, improve forecasting, and derive more value from their cloud investments.

Key Benefits

- Cost Optimization: Identify unused resources and improve usage patterns to minimize cloud expenses.

- Financial Accountability: Increase visibility into cloud spending across teams by showback strategies for accurate allocation.

- Predictable Budgeting: Achieve predictable budgeting through accurate forecasting.

- Efficiency and Agility: Align cloud usage with business goals to improve efficiency and decision-making.

Biggest Challenges Facing FinOps Implementation

- Cultural Adoption: Encouraging cross-functional collaboration between finance and engineering teams.

- Visibility and Data Quality: Obtaining accurate, real-time data for comprehensive cloud spending visibility.

- Rapid Cloud Evolution: Keeping up with market trends and constantly evolving cloud pricing models, tools, and best practices.

- Tool Complexity: Selecting and implementing appropriate FinOps tools.

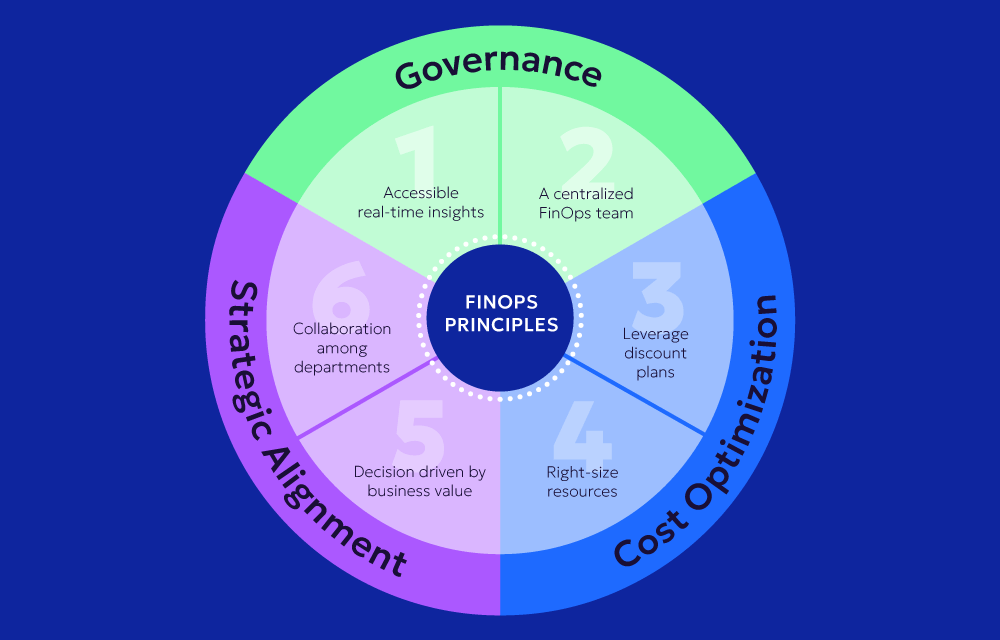

FinOps framework for success

- Collaboration: Foster teamwork between finance, IT, and engineering.

- Cost Allocation: Apply chargeback models to distribute cloud costs.

- Continuous Optimization: Regularly analyze usage to eliminate waste and improve resource allocation.

- Automation: Utilize automation tools for data collection, reporting, and optimization.

- Governance and Control: Implement guardrails and policies to balance control with innovation.

Business Case: Successful FinOps Framework at Pulsar Analytics

Pulsar Analytics, a SaaS provider specializing in data analysis tools, found their rapidly growing cloud usage difficult to manage efficiently. Each product team operated in isolation, leading to inconsistent cloud resource management. This fragmented approach resulted in a lack of transparency into overall cloud spending and the accumulation of underutilized or over-provisioned resources, driving up costs. They struggled to create accurate budgets and had difficulty justifying their escalating cloud expenditure.

To address these challenges, Pulsar Analytics adopted a comprehensive FinOps framework, focusing on collaboration, automation, and data-driven optimization:

- Collaboration: Pulsar created a dedicated FinOps team, bringing together finance, engineering, and product managers to collaborate on cloud cost management strategies. This multidisciplinary team broke down silos and fostered a culture of shared financial accountability, leading to data-driven decision-making.

- Cost Allocation: They implemented a chargeback model that linked cloud usage directly to product teams. Each team was assigned specific usage metrics to encourage responsible spending and align usage with their budgets.

- Automation and Tool Implementation: Pulsar adopted a FinOps automation tool that provided real-time visibility into cloud costs and usage patterns. The tool automated cost reports, provided actionable recommendations for rightsizing resources, and identified unused or underutilized instances. This reduced the burden of manual analysis and ensured rapid implementation of optimization measures.

- Continuous Optimization: They established policies for automated shutdown of idle resources and ensured that instances were right-sized based on actual workload demands. Product teams regularly reviewed their resource utilization, enabling continuous identification of opportunities for cost-saving optimizations.

- Governance: Pulsar implemented strict governance policies to prevent over-provisioning and enforce cloud resource management best practices. They set up proactive alerts for unusual spending patterns and required regular compliance audits for cloud resources.

Results

Within six months, Pulsar Analytics achieved a 35% reduction in cloud costs. Their new FinOps framework improved budgeting accuracy, making forecasting more predictable. The FinOps tools enabled engineering teams to understand and optimize their usage, leading to greater agility and faster decision-making. By fostering a culture of financial accountability and providing actionable insights, Pulsar Analytics established a sustainable model for long-term, cost-effective cloud operations.

Key Takeaways

FinOps is vital for optimizing cloud spending and ensuring efficiency and agility. By following principles like collaboration, automation, and governance, organizations can reduce costs, align spending with goals, and achieve predictable cloud usage.

Further Resources

For those looking to expand their understanding of FinOps, these reliable, informative resources provide valuable guidance:

- FinOps Foundation

Description: The FinOps Foundation is a collaborative platform for sharing best practices in FinOps. They offer resources like training, certification, and community discussions to help organizations implement effective FinOps practices.

Link: FinOps Foundation - AWS Whitepapers on Cloud Financial Management

Description: Amazon Web Services offers comprehensive whitepapers on cloud financial management. These documents provide valuable insights into managing costs and optimizing investments within AWS.

Link: AWS Whitepapers - Google Cloud’s Guide to Financial Governance in the Cloud

Description: Google Cloud provides guides and best practices for financial governance in the cloud. This is especially useful for managing cloud spending under a FinOps framework.

Link: Google Cloud Financial Governance - Microsoft Azure Cost Management and Optimization

Description: Microsoft offers detailed guides on implementing effective cost management strategies for FinOps in Azure, including tips on optimizing cloud investments.

Link: Azure Cost Management - The Open Group: IT Financial Management

Description: The Open Group provides a broader perspective on IT financial management, offering insight into managing IT costs, which is integral to FinOps.

Link: The Open Group IT Financial Management

These resources deliver a comprehensive foundation for anyone seeking to deepen their understanding of FinOps principles and their practical applications.