Starting The FinOps Journey: The Ultimate Guide

CEO and Co-founder

What is FinOps?

Are you starting your FinOps journey and not sure where to begin? You’ve come to the right place! This guide will provide you with everything you need to know for cloud financial operations excellence.

Let’s start from the beginning, shall we? Classically, managing cloud spend fell into the roles of DevOps, CloudOps, or Cloud Administrators. But today, FinOps is the new kid on the block–and they may just transform our cloud environments to unleash greater financial efficiency.

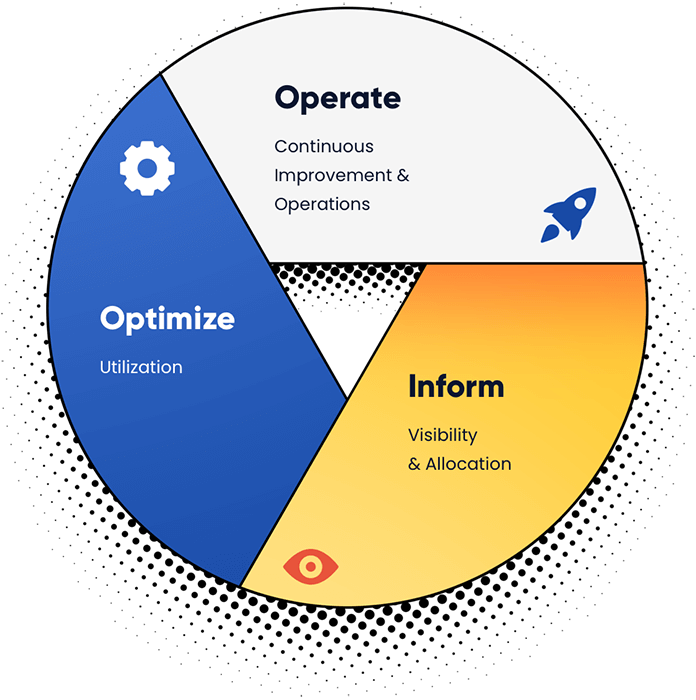

FinOps, or financial operations, is the intersection of people, process, and technology as it relates to cloud financial operations. Although it’s more popular in large organizations, mid-size organizations are also beginning to jump on the bandwagon as they realize that solid planning, budgeting, and resource allocation is needed to minimize cloud spend.

Unlike DevOps or CloudOps, FinOps’ core objective is designing cost efficient cloud operations. They do so by taking a holistic, and proactive approach to planning and architecting a financially smarter cloud.

If you’ve ever tried to take on the responsibility of cloud budgeting and cloud financial management, you know it’s no simple task. Cloud pricing models and service offerings are complex and require lots of planning, structuring, and tooling to ensure your cloud operations are both scalable and financially efficient.

So if you’re a FinOps newbie looking to get started, it’s your lucky day! Here are some guidelines you should follow.

Map your existing usage

When starting your FinOps journey, visibility is critical. Because it’s so easy to open an account on AWS and start spinning up instances, people often fail to make the right initial preparations to prevent costs from getting out of hand. To make matters even more complex, there are often many departments and individuals working in the cloud, so lack of governance and accountability can become issues.

So the first step in gaining visibility is to map out each of your cloud users/stakeholders, what cloud purchases they are making, and what agreements they have signed.

It’s also critical to understand their needs. Find out why they are purchasing particular cloud services, what their technical requirements are, and what their use cases are. This way, you can create different routes per use case which enable them to enjoy the agility and flexibility of the cloud in the most responsible manner possible.

Part of your mapping strategy should include using BI tools to get a deeper understanding of how your cloud resources are being used, for what purposes, and who the stakeholders are. You can use your cloud provider’s native BI tools, or build your own to fit your business’s specific needs.

Soft skills are also important here. You cannot create a mapping strategy without cooperation from the engineers working in the cloud. So come from a place of understanding and transparency to win their partnership and respect. This way, you can get their buy-in once you put cloud financial processes and procedures in place. Remember, they moved to the cloud to increase flexibility and agility. So make sure to be clear that your purpose is to accelerate — not hinder–this process.

Tagging Assets

To enhance visibility even further and ensure it continues as you grow, you’ll need to tag your assets. Tags are metadata labels that you attach to each of your resources. They can be set according to any identifying criteria you choose such as business unit, main user, product/feature, etc.

Tagging will help you drill down into what costs are being incurred, for which product/feature, and which team or individual is responsible for managing it. Before setting a tagging strategy, it is important to partner with all key stakeholders. Together, you can strategize about what cost and optimization questions you want answered and how to create tags which provide all the necessary information you seek. This is a good way to align business needs with engineering priorities.

Defining a cloud budget

Now that you have set the groundwork and (hopefully) have your engineering team on board, it’s time to create a realistic cloud budget–woohoo!

Remember when we said understanding technical requirements would enable you to create various architectural options per cloud use case? Now this concept is being applied. Mapping your cloud usage has allowed you to understand your run rate, which will enable you to build cloud architecture which makes sense both technically and financially. Once you select the ideal architecture for your cloud environment, you can start to build your budget around that.

Of course, budgeting doesn’t end once you set it. You’ll need to constantly monitor usage to see if it’s in line with the budget and if it’s not, either reevaluate the budget or ideally, see where you’re creating waste and identify areas where you can cut costs.

Make sure you have at least one champion in every business unit so you can effectively communicate with the end users on relevant budgeting concerns and considerations.

Building a winning FinOps team

If you haven’t noticed already, people are the most essential part of starting your FinOps journey. You need your technical colleagues’ buy-in, their expertise, and their cooperation to ensure your financial cloud management plans do not come at the expense of their ability to innovate.

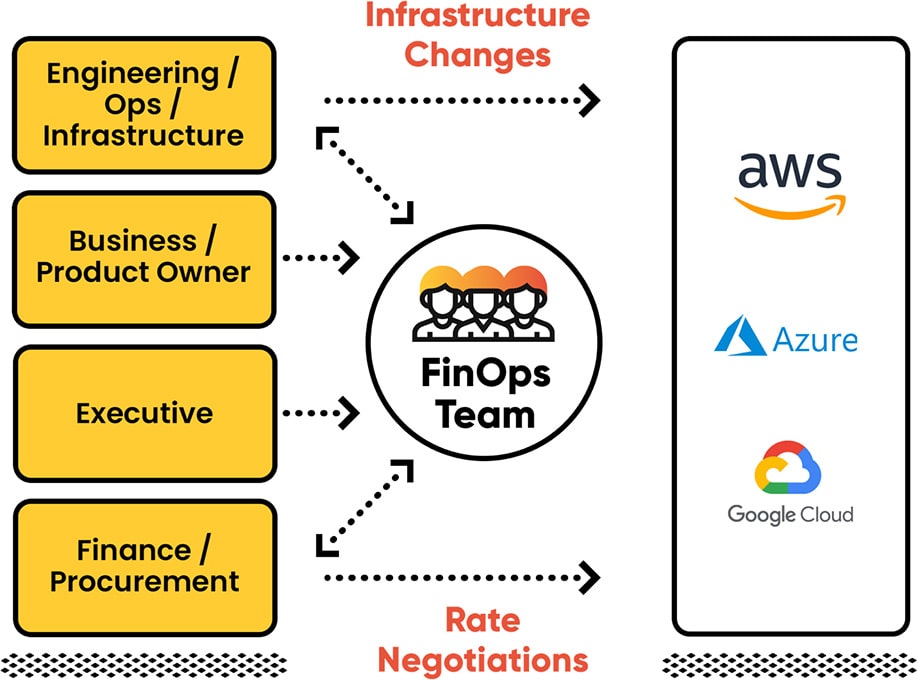

Same goes with building your own FinOps team. Hiring the right people is a fundamental part of building a well-rounded FinOps team. While it may be tempting to try and hire a “jack of all trades”, this is difficult to find and can often yield ineffective results since most people cannot be experts in many different areas. So Instead, make sure each of your FinOps hires come with vast knowledge in one particular area. For example, hire one person with financial orientation, one technical person, one business analyst, and one governance expert to cover all aspects of FinOps at a high level.

Someone from engineering, ops, or infrastructure has experience working in the cloud, developing applications, building cloud architecture, and understanding technical storage needs. A financial expert on the other hand, will excel at planning, budgeting, and creating a reasonable financial plan. Business analysts will use their expertise to delve deep into the processes, systems, and cloud resources that are being used and find ways to optimize them. And finally, an executive or someone who is in charge of governance will ensure all stakeholders are taking ownership for the resources they manage while ensuring the entire FinOps process is operating smoothly. Since FinOps is in and of itself a multitude of different areas of expertise, having a team made up of individuals that represent each specialization will be an ideal way to ensure each aspect of FinOps is thoroughly addressed.

In addition, hiring someone from within your own organization can help alleviate some of the learning curve so you can start moving faster.

Aligning the company – Changing their mindset

FinOps and DevOps don’t have to be enemies. In fact, if you show you’re on the same team from the very beginning, it will be easier to establish governance and to build a culture of cloud financial responsibility.

The first step to aligning the company is understanding the engineering pain points as well as the business pain points. What are your engineers having difficulty with? What aspects of the cloud keeps them up at night? Understanding their needs, providing value, and coming up with mutually beneficial solutions is the best way to get all your colleagues on board with cloud financial planning and optimization.

Another key way to get alignment is through visibility. If your engineers can see they are only using a small percentage of the resources they have purchased, there’s no mistaking the fact that they need to cut back. So create a system where they can see their own cloud usage so they’re empowered to act accordingly.

Lastly, make it as easy as possible for your engineers to optimize costs. Automation should play a key role in the way you’re managing the cloud. This way, they have to make little to no hands-on effort to ensure savings.

FinOps KPIs – How to measure success

KPIs, or key performance indicators, are a way to measure the strategic impact of specific activities and approaches in relation to core business objectives. A KPI should track progress of business goals in a manner that is data-driven and indicates progress.

So what KPIs can you use to measure FinOps success? It depends on your company’s specific business goals. But if you’re looking for a place to start, the FinOps Foundation produced a great list which we’ll elaborate upon. This list includes:- RI Coverage

- Savings Plan Coverage

- Committed Use Discount coverage

- Rightsizing opportunity value

- Usage on weekends vs weekdays

- % of spot vs other coverage

- custom pricing commitment tracking

- % orphaned EBS volumes

- % orphaned snapshots

- Aged snapshots

- Idle instances > 30-days

- Idle instances < 30-days

- Total bill vs. forecast – including variance % of forecast: actual bill

- % of oversized instances (not tagged as approved)

- % S3 storage on the wrong tier

- % EBS storage on wrong tier

- % unattached elastic IPs

- % wrong instance type

- % dev resources running out of hours (this means, running out of non-peak hours, like nights and weekends

- % untagged resources

- % wrongly tagged resources

- % total tag coverage

- % taggable items tagged

- % of spend that is untaggable

- Hours between cost incurred and cost displayed to end team

- Frequency of data updates

- Avg price per hour of compute

- Unit cost (spend divided by a business metric)

Let’s get more specific about some of these, shall we?

When measuring RI and SP usage for example, it is important to understand what percentage of your cloud instances are covered by RIs and SPs before and after you implemented a FinOps strategy, and how much money you are saving as a result. Likewise, when measuring rightsizing opportunity value, you should find out how many of your instances have been rightsized, how many should still be rightsized, how much cloud spend was reduced because of your efforts, and how much opportunity there is to increase savings.

Normally, your forecasting efforts should be measured against your actual cloud bill in order to understand how accurate your predictions are. However, when using Zesty’s commitment manager you don’t need to worry about adjusting your predictions to make sure they are on target. Zesty’s solution helps you to decrease your usage and save significant cloud spend so you stay well within your cloud budget.

Remember that when creating KPIs, they should not only consider costs, but also performance and efficiency. This is where Zesty has become a crucial element in many of our customer’s cloud ecosystems. Zesty’s solutions make it possible to achieve your ultimate goal of unleashing the cloud’s agility and flexibility, but in the most cost effective way possible.

Final thoughts

Starting your FinOps journey is complex to say the least. But the results can be quite rewarding when thousands of dollars are saved. You help your business get the most value out of the cloud, while enabling your engineers to benefit from the cloud’s full potential. It’s a tricky balance at first, but once policies are established cooperation is earned, and tools like Zesty are deployed, the process works seamlessly without any hassle.

But don’t take our word for it. Get real perspectives on starting a FinOps journey from Amdocs’s Senior Global Procurement Manager, Shunit Kainy.

Want to automate your FinOps processes? Chat with one of our cloud experts to learn how you can reduce cloud costs with zero engineering effort.

Related Articles

-

Zesty now supports In-Place Pod Resizing for Seamless, Real-Time Vertical Scaling

Zesty now supports In-Place Pod Resizing for Seamless, Real-Time Vertical Scaling

July 30, 2025 -

The endless cycle of manual K8s cost optimization is costing you

The endless cycle of manual K8s cost optimization is costing you

July 2, 2025 -

Why major Kubernetes monitoring vendors miss the mark on cost visibility

Why major Kubernetes monitoring vendors miss the mark on cost visibility

February 27, 2025 -

Rethinking CPU Utilization Practices

Rethinking CPU Utilization Practices

January 21, 2025 -

How FastScale Technology Optimizes Kubernetes Deployments

How FastScale Technology Optimizes Kubernetes Deployments

January 2, 2025